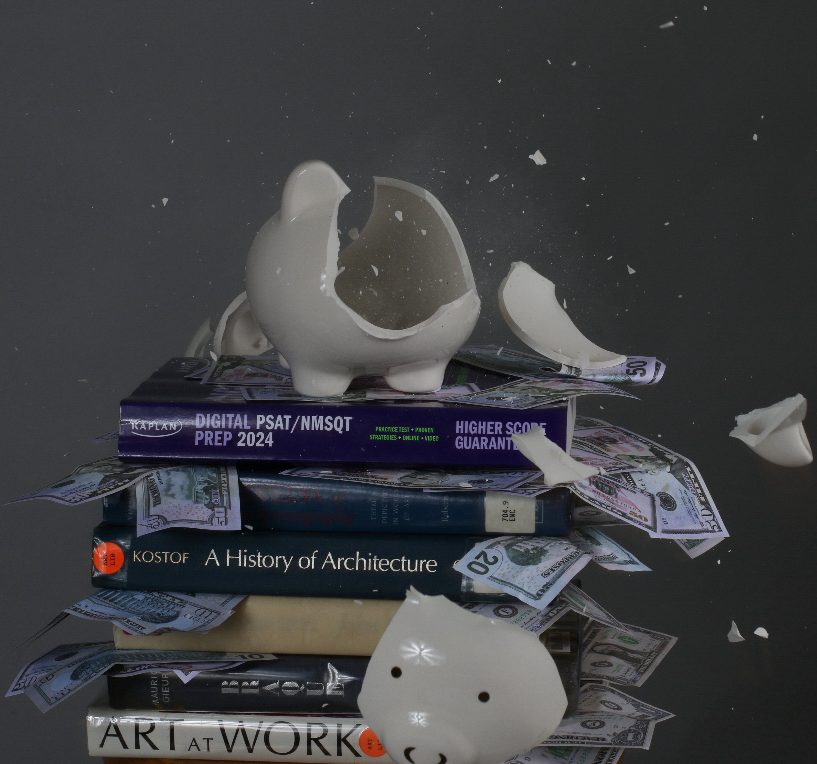

Tracking a company’s profits, assessing values, and dividing cash among businesses: All of these entail a hobby that isn’t unheard of among teens. Contrary to popular belief, students, like piano junior Ethan Cheung, have ventured into the realm of funds, investments, and stocks. To some, those words sound like bland jargon, but to others, they represent a passion rooted in the world of finance.

While minors don’t have the legal authority to invest privately, those under 18 may open an investment account under a custodial account, which transfers the responsibility of the account to their legal guardians. This offers an alternative to mainstream employment options for teenagers, like working as baristas or cashiers.

Earning money through investments seems like a laborless effort to get rich fast, but it takes a lot of time, effort, and research. Cheung says that for investors, “research is the most important part.”

“Do your background research before you buy stocks because it’s real-life money,” piano junior David Liu said. “[Whether you’re] working with your parents’ money or whatever you use, make sure you’re spending it wisely.”

Liu sees investing as a personal hobby and began around winter break of last year. He started when he wanted to get a pair of shoes but didn’t have the money to splurge. Looking for a way to get the money that didn’t involve applying for an actual job, he began investing.

“I didn’t get [the shoes] for Christmas, so I was like, ‘You know what, I might as well invest,’” Liu said. “That was while I was looking at the news, and I saw this app called Robinhood [being advertised as] the millennial investing app, so I downloaded it and it’s been working ever since.”

On the other hand, Cheung began investing around ninth grade and has grossed about $1,500 since starting. Cheung used the money he received from relatives on Christmas and Chinese New Year to invest in stocks.

“I’d rather drop out of high school and start investing,” Cheung said. “High school is useless. If I could make money and spend my time making money rather than sitting at school … then I’d rather do that.”

Social studies teachers Brett Burkey and Danielle Edwards feel that the unique challenges posed to this generation, like college debt and hyperconsumerism, make it more of a necessity for students to start saving and investing.

“Being able to support yourself and be self-sufficient has always been important, but it costs so much more now than it ever did before,” Ms. Edwards said. “You couldn’t just depend on your parents to pay your tuition or something like that. Because your life is more expensive, you are working toward helping pay down the costs of life.”

Mr. Burkey agrees with Ms. Edwards, stating that “if kids don’t look out for themselves, then no one’s going to look out for them.” Mr. Burkey is an advocate for financial literacy in youth and has been involved for the past six years in state legislation aiming to make financial literacy a graduation requirement.

“Financial literacy is a 21st century survival skill,” Mr. Burkey said. “It’s a set of skills that we do a lot of talk about it, but there’s been very little action in embedding it into the curriculum and making it a requirement.”

However, the current nature of society—preoccupied with the latest trends and fads—makes it hard for students to choose how much money they will spend and save. Mr. Burkey stresses the idea that “money that you spend today is money that you can’t save initially, but it’s money that you can’t spend in the future.”

“Don’t listen to the people around you who are telling you, ‘Oh, why are you doing that? You should be living life. You should be enjoying yourself.’ That’s baloney,” Mr. Burkey said. “Be completely blind to the short term trends. Forget about the noise and the ups and downs of the daily market. Don’t worry about that.”

Despite the obstacles involving potential loss of money, heavy outside research, and—ultimately—self-discipline, students still find satisfaction in investing and making money, no matter the amount of return. Liu mentions that “working with real world money” means managing responsibilities, “[making] you feel more independent.”

Ms. Edwards believes that investing provides “a nuanced understanding of the way different outside influences impact … the stock market,” emphasizing the importance of experience. “When you’ve got something riding on [investments], like your money, you experience it, as opposed to being told by someone, ‘This is the impact of whatever on the market.’”

While Mr. Burkey and Ms. Edwards agree with Liu that the experience of working with the stock market teaches students about responsibility and accountability, Mr. Burkey believes that investing and saving money offers something far greater: liberty.

“The greatest benefit is freedom,” Mr. Burkey said. “If you have savings [and] investments and you want to switch jobs, you have money to do that. If I’m living paycheck to paycheck, then I don’t have any choices. If you have savings and you have investments, then you have freedom. And there’s nothing better than having choices.”

![Dance sophomore Mason Evans and dance junior Brenan Gonzalez were just two of several male dancers in last year’s Spring Concert. “I think the biggest challenge [of being a male dancer] is all of the stigmas and stereotypes that come around,” dance junior Alex Thomas said. “[People say], ‘Oh, ballet or dance is not a sport and you don’t have to work as hard and this and that.’ Growing up and defying all of those odds is a challenge.”](https://www.themuseatdreyfoos.com/wp-content/uploads/2019/09/IMG_1547-1-e1568827392719-600x900.jpg)

Long Hairstyles • Oct 21, 2020 at 8:56 pm

Howdy! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the fantastic work!